✓ IRS AUTHORIZED CAA

✓ CLEAR CHECKLIST

✓ TRANSPARENT PRICING

✓ NO FALSE PROMISES

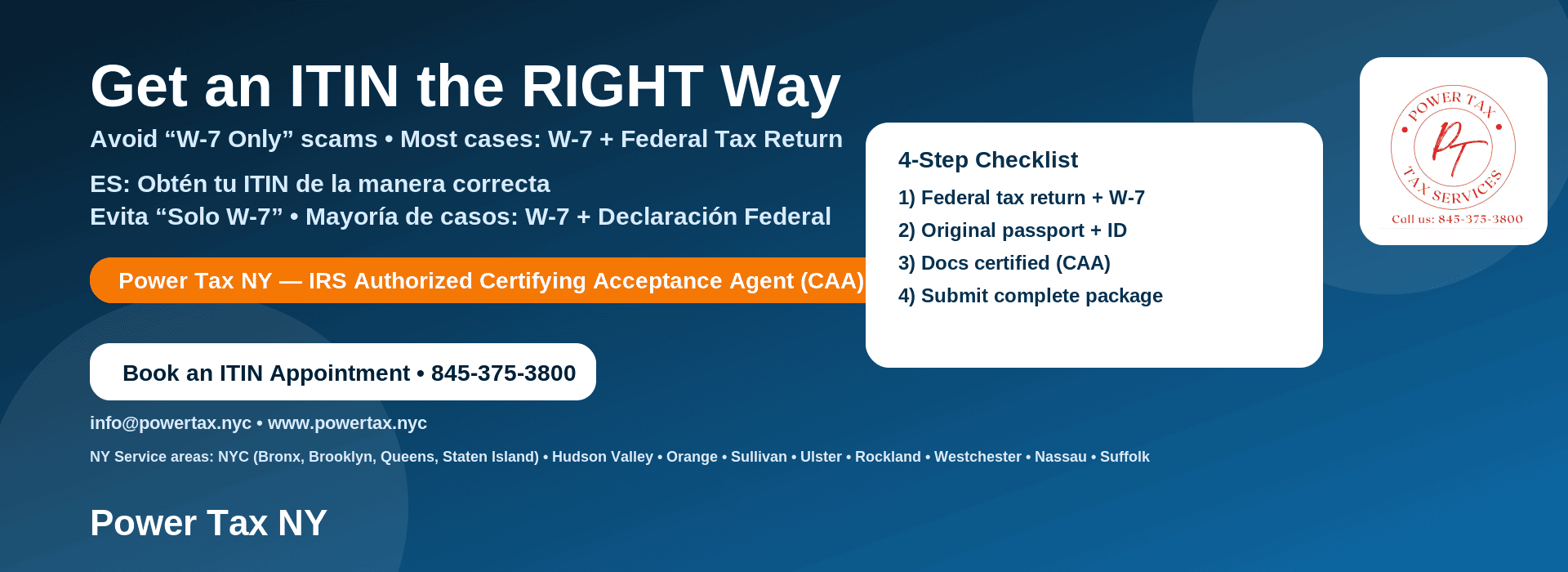

Get an ITIN the RIGHT Way

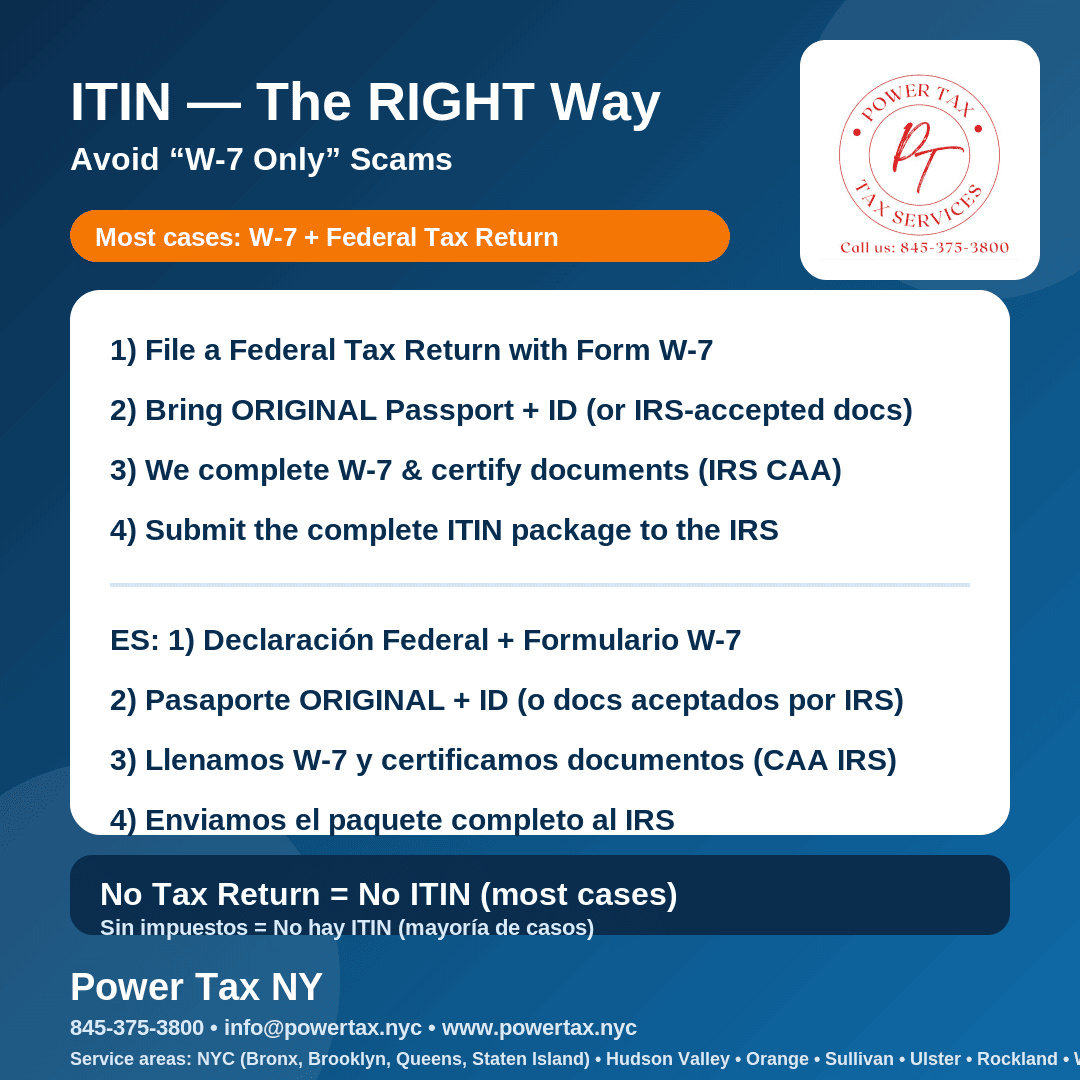

Avoid “W-7 Only” scams. In most cases, Form W-7 must be filed with a federal tax return (unless you qualify for an IRS exception).

The Reality:

The IRS generally requires Form W-7 + a federal tax return. If you don’t file the right package, you can lose months waiting for a denial letter.

We help you navigate the complex IRS requirements securely.

How to Apply (The Correct Process)

01. Prepare Tax Return

We prepare the federal tax return that must be filed with the ITIN application.

02. Complete Form W-7

Accurate personal information matching your ID documents exactly.

03. Authenticate Docs (CAA)

As a Certifying Acceptance Agent, we certify your passport/ID so you keep your originals.

04. Official Submission

We submit the complete package to the IRS and provide follow-up support.

What to Bring

- Passport (Preferred) + Secondary ID (NY ID, License)

- Income forms (W2, 1099) & dependents info

- Current address & prior IRS letters (if any)

🚩 Red Flags to Avoid

- “No tax return needed — W-7 only”

- “Guaranteed approval”

- Asking to mail originals without safer options

Frequently Asked Questions

Can I apply with only Form W-7?

Usually no. Most cases require W-7 to be filed with a federal tax return, unless a specific exception applies.

Do I have to mail my passport to the IRS?

Not always. With a CAA appointment, we can certify documents in our office so you don't need to mail originals.

How long does it take?

IRS processing times vary. Incomplete packages or missing documents are the biggest cause of delays.

What if I was denied before?

Bring your IRS letter. We will fix the errors and resubmit your application correctly.

Ready to apply the RIGHT way?

Power Tax NY — ITIN + Tax Filing + Support

SERVICE AREAS: NYC (Bronx, Brooklyn, Queens, Staten Island) • Hudson Valley • Orange • Sullivan • Ulster • Rockland • Westchester • Nassau • Suffolk

Disclaimer: This page is for general information and is not legal advice. IRS rules can change.